While the total impact of Covid-19 may never be fully measured, I do know that it affected RPM in myriad ways. Despite implementing stringent health and safety protocols, more than 1,600 RPM associates around the world contracted the virus over the past 15 months. This led to more than 15,000 lost associate days for recovery and quarantine and over 1,000 days of manufacturing and distribution facility closures due to quarantine and disinfecting protocols. This impact is multiplied when considering the repercussions the pandemic had on our supply chain and customers.

While we can assign some metrics to the impact the pandemic had on our company, it is impossible to calculate the personal toll this past year had on so many of our associates. Sadly, we lost more than a dozen individuals to the virus and know that the burden it placed on family and friends across the globe is immeasurable. Despite these hardships, our associates performed in a combined effort that can only be described as heroic.

Because of this dedication, we saw an extraordinary year of performance and also experienced firsthand how the trust that has been built over decades between our companies, customers and suppliers paved the way for goodwill efforts that allowed us all to tackle the challenges we faced together.

As of May 31, we successfully concluded our MAP to Growth operating improvement program, which we initiated in 2018. At its onset, we had achieved decades of success under our decentralized business model and, over this time, RPM grew in size, scale and complexity. We recognized that the company had reached the point where a center-led approach in select areas of the business was required to get it to the next level of growth.

The primary elements of the MAP to Growth program were to increase the efficiency of our operations – particularly in the areas of manufacturing, procurement and administration – and to streamline our operating structure and leadership, all while maintaining our successful entrepreneurial growth culture. The plan focused on scale in order to unlock more resources to better serve our customers, while creating greater value for our shareholders.

Our manufacturing facilities had historically been managed by our individual operating companies. Through the MAP to Growth program, we looked at these fixed assets from a more holistic view. In the process, we formed a center-led manufacturing and continuous improvement team that has created a lasting culture of manufacturing excellence and continuous improvement disciplines across the organization. This team launched our MS‑168 manufacturing system, which is allowing us to produce better products more quickly, cost effectively and sustainably. Additionally, we reduced our global manufacturing footprint by 28 facilities and consolidated production at more strategically advantageous plants.

We also created a center-led procurement team that has consolidated material purchasing across our operating companies and negotiated improved payment terms with our supplier base that helped us reduce working capital. These initiatives have created millions in cost savings. With stronger supplier partnerships and longer-term contracts, we are much better positioned to secure necessary raw materials and control costs through the current supply chain challenges.

Additionally, we took significant steps to streamline many of our administrative functions. Through our financial re-alignment, we consolidated 46 accounting locations, improved controls, developed more effective and efficient accounting processes, and reduced costs. Similar initiatives were undertaken in information technology. We have migrated 75% of our organization to one of four group-level ERP platforms, reduced the number of data centers we managed by moving more systems and hardware to the cloud, and created platforms for centralized, data-driven decision making.

As a result of these actions, I’m proud to share that we exceeded our original goal by $30 million, generating annualized cost savings of $320 million.

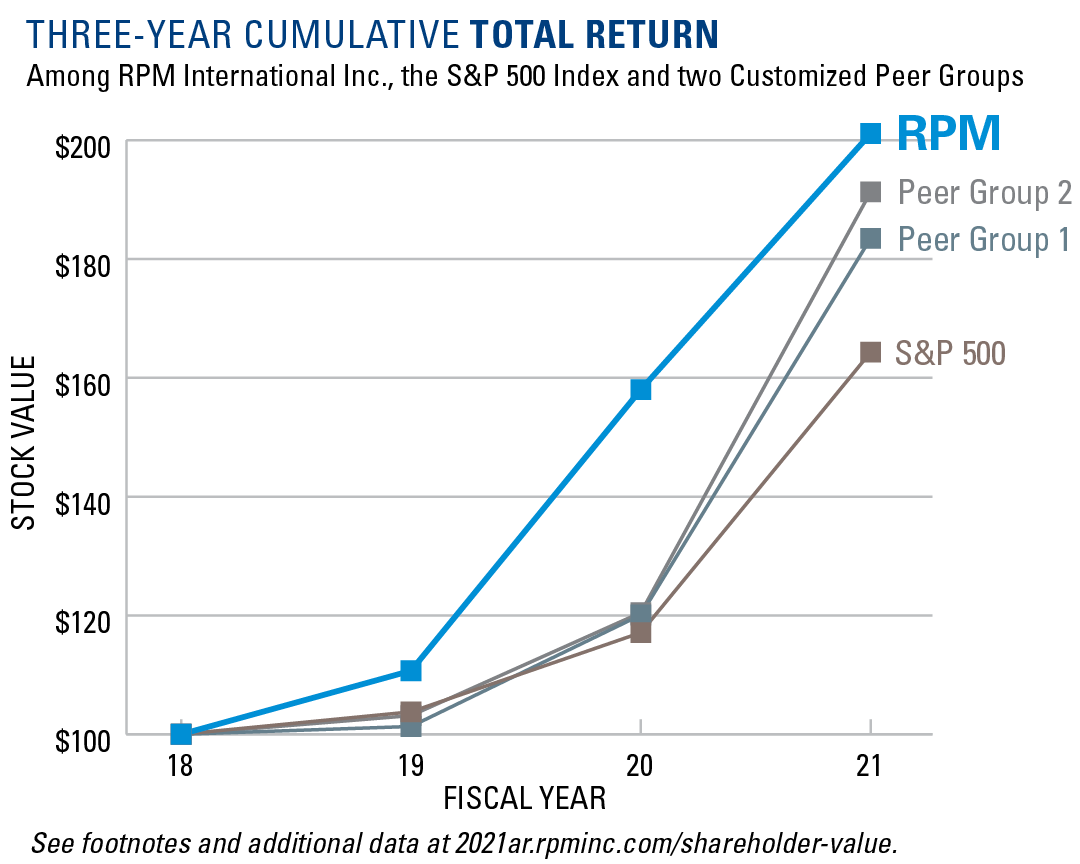

Aside from a significantly improved profit margin profile and stronger cash generation, as reflected in the industry-leading cumulative total return generated by RPM over the last three years, the lasting legacy of our MAP to Growth program is the operational disciplines we developed that will continue to generate improvements in profitability, cash flow and return on investment metrics. Perhaps more significant was our ability to maintain our unique entrepreneurial, growth-oriented culture—evidenced by the fact that our revenues continued to grow at or above our industry averages throughout the MAP to Growth program.

I attribute the success of our MAP to Growth initiatives to all of our associates worldwide, but in particular to the frontline workers who kept our manufacturing and distribution centers operating during the pandemic. We also owe a debt of gratitude to my good friend and one of RPM’s great operating leaders, Steve Knoop, who was the architect of the MAP to Growth program and passed away prematurely in 2019. I would also like to recognize Mike Sullivan, vice president of operations and chief restructuring officer, Tim Kinser, vice president of operations–procurement, and Gordy Hyde, vice president of operations–manufacturing, who successfully executed the program with an intense focus and tremendous leadership that were integral to delivering strong results and instilling a permanent focus on operating efficiency and continuous improvement into our culture.

While we have reached the MAP to Growth’s conclusion, there’s still more work to be done. Our next step is to leverage the lessons learned from the program to chart a course for 2025. RPM has always been exceptional at growing the top line. Now, thanks to MAP to Growth, we are a much more efficient business as well. This is a powerful combination that has us well-positioned for another decade of growth and success.

RPM maintains a deliberate strategic balance between our consumer and industrial businesses. This balance serves RPM and its shareholders well, particularly during challenging economic times when weakness in one segment will be offset by strength in the others. The benefits of our operating structure were particularly evident this fiscal year. While our Consumer Group led RPM’s sales and earnings growth through much of the pandemic, it was our other three segments that led the way during the fourth quarter.

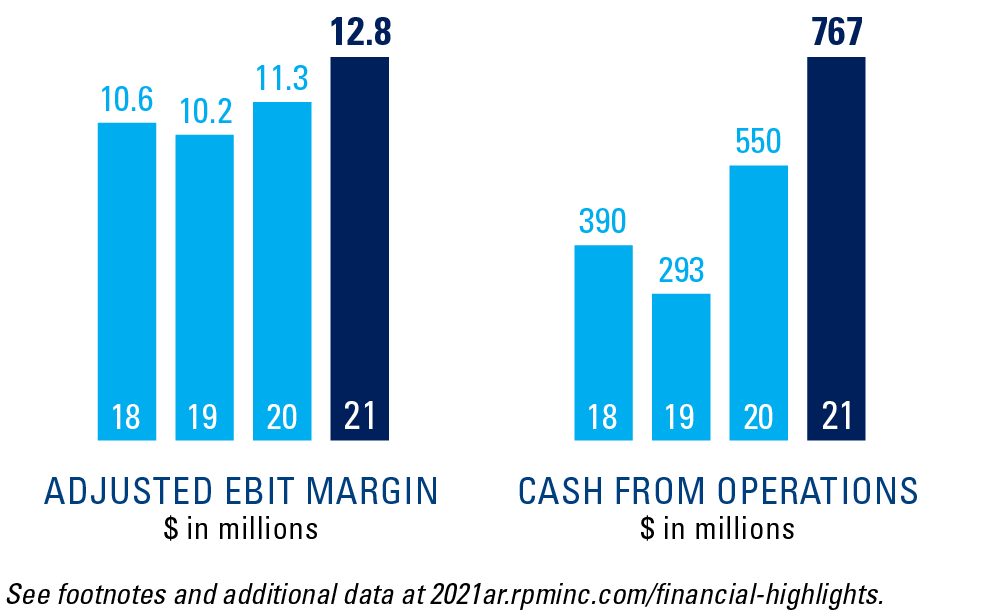

Despite the innumerable and unprecedented challenges presented by a global pandemic, we saw strong results for fiscal 2021. Net sales were $6.11 billion, an increase of 10.9% compared to $5.51 billion during fiscal 2020. Organic sales increased 8.1%, while acquisitions added 1.8%. Foreign currency translation increased sales by 1.0%. Net income was $502.6 million, an increase of 65.1% compared to $304.4 million in fiscal 2020. Diluted earnings per share (EPS) increased 65.4% to $3.87 versus $2.34 a year ago. Income before taxes (IBT) was $668.4 million compared to $407.8 million reported in fiscal 2020. Earnings before interest and taxes (EBIT) was $709.4 million, an increase of 42.2% versus the $499.0 million reported last year.

Fiscal 2021 and 2020 included restructuring charges and other items that are not indicative of ongoing operations of $75.2 million and $121.3 million, respectively. Excluding those items in both years, RPM’s adjusted EBIT was up 26.5% to $784.6 million compared to adjusted EBIT of $620.3 million last year. Investment returns resulted in a net after-tax gain of $31.2 million during fiscal 2021 and a net after-tax gain of $1.1 million last year. Excluding the restructuring and other items, as well as investment gains and losses, adjusted diluted EPS for fiscal 2021 increased 35.5% to $4.16 compared to $3.07 in fiscal 2020.

Our businesses remained focused on growth and continued to develop new, innovative solutions for our customers. We added five new businesses to the RPM family over the course of fiscal 2021 and at the start of fiscal 2022. Our companies also continued to develop new solutions to meet customer demands. You can learn more about the businesses we've acquired and our innovative new products on the pages of this website dedicated to our four operating segments: Construction Products Group, Performance Coatings Group, Consumer Group and Specialty Products Group.

Our cash from operations increased 40% over last year’s record, primarily due to good working capital management and margin improvement initiatives. Cash from operations was $766.2 million compared to $549.9 million during fiscal 2020. Because of our strong cash flow, we reinstituted our stock buyback program and were able to complete multiple acquisitions, while reinvesting in the growth of our businesses. All working capital metrics improved during the year. Capital expenditures during fiscal 2021 were $157.2 million compared to $147.8 million in fiscal 2020. Total debt at the end of fiscal 2021 was $2.38 billion compared to $2.54 billion a year ago. RPM’s total liquidity at May 31, 2021, including cash and committed revolving credit facilities, was $1.46 billion.

In October, our board of directors increased our cash dividend by 5.6% to $1.52 on an annualized basis. This was the 47th consecutive year we have increased our dividend to shareholders—a record only a handful of other publicly traded companies can match. Increasing our dividend each year is one way we reward our long‑term shareholders. The benefit of this practice is reflected in our total shareholder return, made up of share price appreciation and reinvested dividends, which has outpaced the S&P 500 by 33% over the past 10 years (see page 21).

Last August, we released our first environmental, social and governance (ESG) report highlighting RPM’s safe, ethical and sustainable business practices, which result in value creation for our key stakeholders. The report discusses RPM’s approach to addressing a broad range of ESG matters, including our code of conduct; governance practices; talent development and associate benefits; commitment to human rights, diversity and inclusion; health and safety culture; philanthropic and community involvement; and sustainable products and processes.

Since releasing our first report, we have continued to evaluate the significance of RPM’s economic, environmental and social impacts; created an ESG webpage to highlight our approach to important matters; and formed an ESG Oversight Committee that reports to our Corporate Governance & Nominating Committee of the Board of Directors to oversee and manage our sustainability efforts going forward. Over the next year, we plan to focus on developing our disclosures around the topics that matter most to the business and our stakeholders. These disclosures will include concrete examples and relevant metrics that demonstrate our track record of taking care of the environment, our associates, customers and communities, which is how we create stockholder value and leave a legacy we can all celebrate.

For more information on how RPM is addressing ESG matters, turn to page 20, or download our ESG report at www.rpminc.com/esg.

Notwithstanding the extraordinary challenges we faced over the last year and a half, the operating environment has become more complicated. We are experiencing unprecedented supply chain and raw materials challenges.

We started seeing a rise in raw material prices at the end of the last calendar year, then we were hit with the huge shock of Winter Storm Uri and its resulting impact on the United States’ primary chemical production in Texas and the Gulf Coast. This trend has unfortunately continued in recent months as certain raw materials spiked by a factor of 200% to 300%.

While many of these spikes have abated, underlying raw material costs are up over the prior year by 15%-20%. Worse yet are certain raw material availability issues that have caused disruptions to some of our operations, broadly to our supply chains and in some cases interrupted our ability to meet rising demand on a timely basis, particularly in the United States.

We are also seeing rising costs throughout our P&L, from higher wages and compensation levels to significantly higher freight costs across all categories, including ocean, rail and truck transportation—which are further impacted by the higher costs of raw materials and packaging.

As a result, we executed price increases in late spring and early summer, and we will likely pursue additional pricing actions.

We do anticipate that the supply chain disruptions and raw material shortages will result in some margin deterioration in the first half of our 2022 fiscal year, and particularly in the first quarter, in light of last year’s extraordinary Consumer Group performance.

Nonetheless, with the continuing benefits of our MAP to Growth program in fiscal 2022, and the pricing actions that were taken earlier this year, we anticipate a return to gross margin and EBIT margin improvement during the second half of the year, and that fiscal 2022 will be another record year of sales and earnings for RPM shareholders.

We will sustain the gains of our MS-168 manufacturing system across our operations, pursuing operating efficiencies throughout RPM with a continuous improvement mindset. With confidence in these new competencies, we are refocusing more of our human and financial capital on top-line growth as we see huge opportunities in our future with existing technologies, new product ideas and acquisitions. We will be less focused on generating quarterly results and more focused on the opportunities that can enhance our margin profile further, accelerate our returns and generate outsized growth over the next three to five years.

On June 2, we announced RPM’s return to the prestigious Fortune 500 list in 2021, ranking at number 489. When our company last earned a coveted spot in 1994, the list featured only the largest industrial manufacturers—a very proud moment for my father and our former chairman and CEO, Tom, who sadly passed away this past November. Soon after, the Fortune 500 expanded to include all public companies in the U.S. I know he would have been ecstatic to learn that RPM has once again achieved the remarkable recognition of being named a Fortune 500 company.

This year, we recognize four of the company’s veteran leaders for their well-deserved retirements: Terry Horan, president of the Consumer Group, who closes out his 17-year career at RPM having created the blueprint and strategy for the recently formed Consumer Group; Keith Smiley, vice president, finance and controller, who has been an integral member of the RPM family for nearly 30 years; Bill Barrie, president emeritus and 40-year veteran of Mantrose Group; and Nick Simpson, managing director of USL Group, who retires following 30 years of service. In addition, Thomas S. Gross retired from RPM’s board of directors, after nearly nine years of service to RPM. Their leadership and vision have played an integral role in the success of this company, and they will be greatly missed.

Never before in my 34-year career at RPM, 18 of which has been as CEO, have I seen or personally felt such emotions—from the extraordinary commitment shown by our associates, despite the burdens Covid-19 placed on them and their families, to the passing of my mentor and father, Tom. Despite all of this, our RPM community demonstrated incredible resilience, commitment and—in too many instances to count—courage. I am grateful to you, our associates, customers, suppliers and shareholders, for the trust and confidence that you put in RPM during this challenging time.

While we successfully completed the MAP to Growth project, the RPM project is never finished. There are a lot of exciting things yet to come, and we look forward to sharing them with you in the years ahead.

Very truly yours,

Frank C. Sullivan

Chairman and Chief Executive Officer

August 25, 2021

From Fortune ©2021 Fortune Media IP Limited. All rights reserved. Used under license. Fortune and Fortune 500 are registered trademarks of Fortune Media IP Limited and are used under license. Fortune and Fortune Media IP Limited are not affiliated with, and do not endorse the products or services of RPM International Inc.