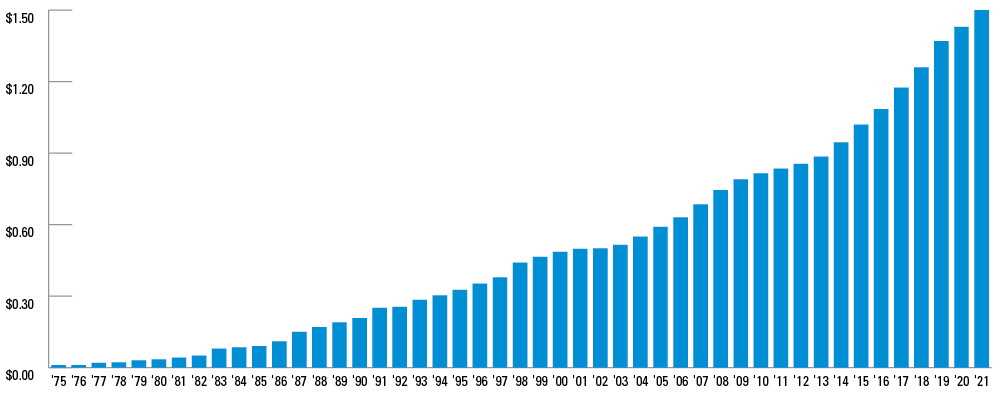

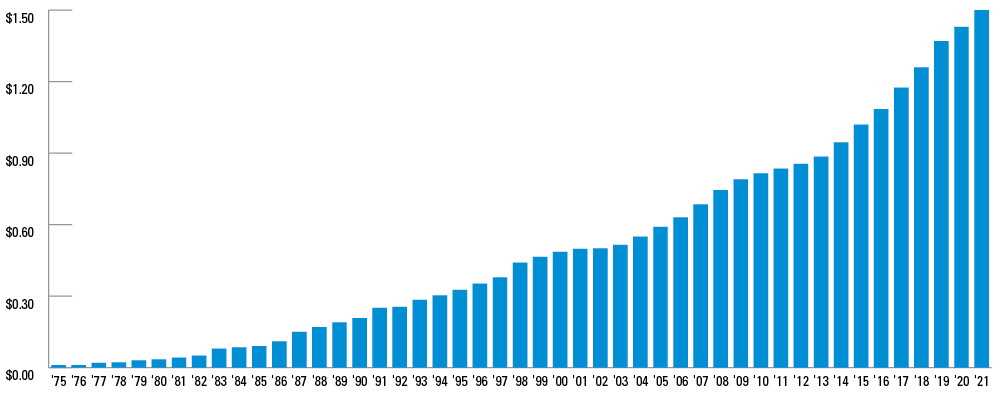

Creating shareholder value for nearly five decades, RPM boasts a stock price appreciation and dividend track record that offer superior, long-term returns for its shareholders.

Only 41* of the thousands of publicly traded companies in the U.S. have an equal or better record

*Source: Mergent Handbook of Dividend Achievers, U.S.: Mergent Inc., April 2021, ISBN 978-1-64972-015-3

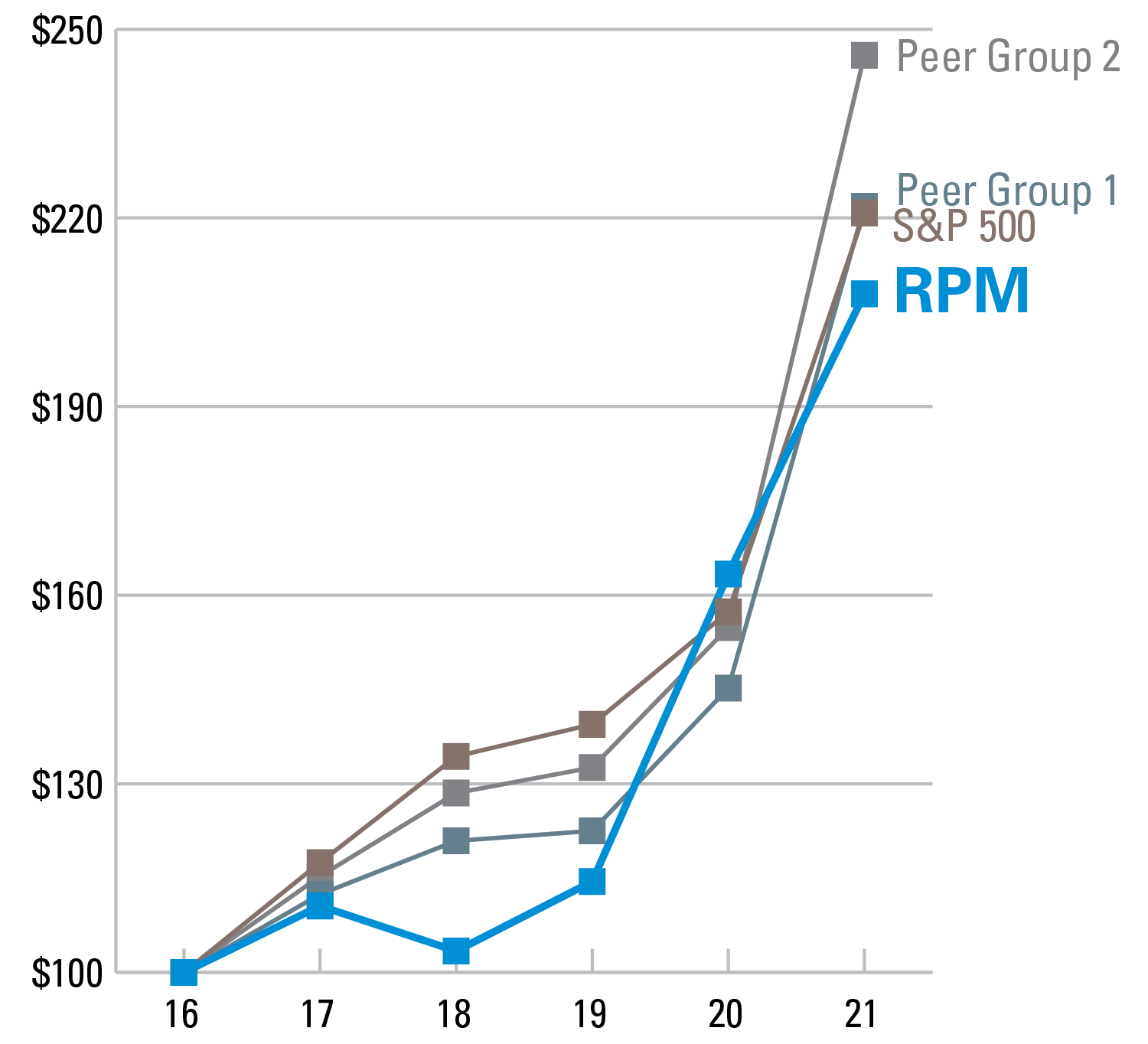

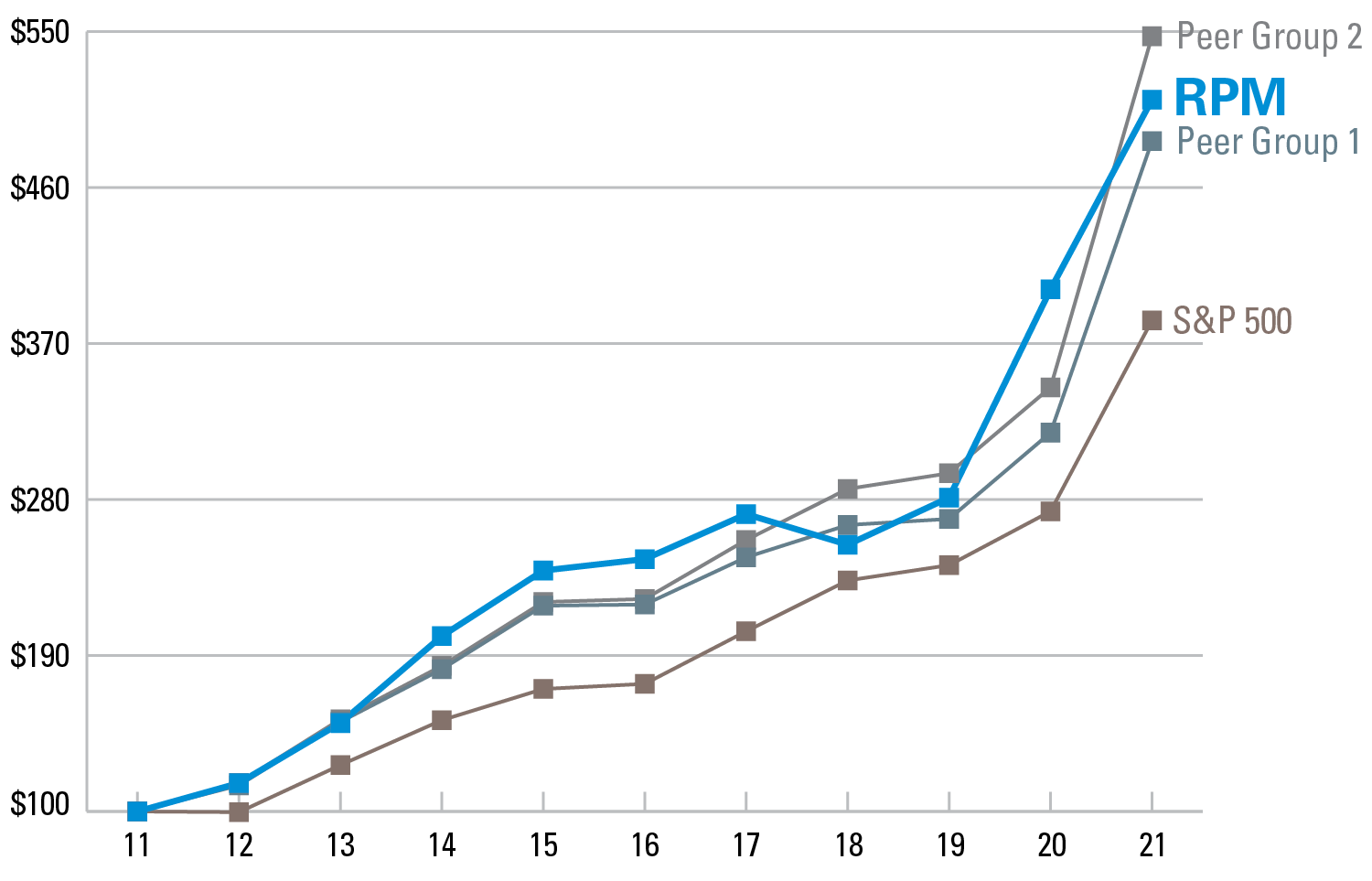

The graphs above compare the cumulative five- and ten-year total return provided to stockholders on RPM International Inc.’s common stock relative to the cumulative total returns of the S&P 500 Index and two customized peer groups whose individual companies are listed in footnotes 1 and 2 below. The graph on page 3 compares the same data over a three-year period. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in RPM common stock, the peer group, and the index on 5/31/2011, 5/31/2016 and 5/31/2018 and their relative performance is tracked through 5/31/2021.

(1) The eight companies in the first customized peer group are: Akzo Nobel N.V., Axalta Coating Systems Ltd., Ferro Corporation, GCP Applied Technologies Inc., H.B. Fuller Company, Masco Corporation, PPG Industries Inc. and Sherwin-Williams Company.

(2) The nine companies in the second customized peer group are: Akzo Nobel N.V., Axalta Coating Systems Ltd., Carlisle Companies Inc., GCP Applied Technologies Inc., H.B. Fuller Company, Masco Corporation, PPG Industries Inc., Sherwin-Williams Company and Sika AG.